Home Buying Guide: Budgeting, Financing, and Property Inspection Essentials

Outline and Budgeting Foundations: Building a Real-World Plan

Outline of this guide:

– Budgeting foundations and cost framework

– Financing options and mortgage math

– Credit, pre-approval, and down payment strategy

– Property inspection essentials and risk control

– From offer to closing: timelines, costs, and buyer safeguards

Before touring homes, map the money. A practical budget protects your search from wishful thinking and helps you avoid the classic trap of falling in love with a place that quietly strains your cash flow. Start with the “housing cost” line: principal and interest, property taxes, homeowner’s insurance, and any association dues. Add utilities, internet, lawn care, and a realistic maintenance reserve (a common guideline is 1% to 3% of the home’s value per year, varying by age and condition). This reserve cushions roof leaks, appliance failures, and the small projects that add up.

Next, plan for one-time acquisition costs. Closing costs often land around 2% to 5% of the purchase price and can include lender fees, appraisal, title services, recording fees, and prepaid taxes and insurance. Moving expenses, immediate repairs, safety upgrades, and basic furnishings also require cash. A simple framework:

– Emergency fund: 3 to 6 months of living expenses

– Closing costs: 2% to 5% of price

– Move-in and first-year fixes: set a flexible buffer based on inspection findings

– Maintenance reserve: 1% to 3% of home value annually

Keep debt-to-income ratios in mind. Many lenders favor a back-end DTI near 36% to 43% (all debts divided by gross monthly income), with a lower housing share—often around 28% to 31%—providing extra breathing room. These aren’t rules for every buyer, but they’re helpful guardrails when comparing options. If rates or taxes shift, run the numbers again; a small change in rate can move monthly costs more than you’d expect.

Consider the rent-versus-buy breakeven horizon. Buying has upfront costs but can build equity over time. Renting has lower friction, but you don’t capture price appreciation or loan amortization. A quick example: suppose closing and selling costs total 8% of price across purchase and resale, and your monthly “owning” premium over renting is $400. If transaction costs total $32,000 on a $400,000 home, you need 80 months just to cover those costs with the monthly difference ($32,000 / $400). Appreciation and tax variables can shorten or lengthen that horizon, so adjust with local data.

Finally, match budget to lifestyle. Commute time, neighborhood amenities, renovation appetite, and storage needs all carry quiet costs—time, tools, and opportunity. A clear plan blends the spreadsheet with daily life, so the home you choose funds your goals rather than competing with them.

Financing Options and Mortgage Math Explained

Your loan structure defines how much house you can comfortably afford and how your payment behaves under different market conditions. Fixed-rate loans offer predictable payments for the full term, while adjustable-rate loans start with a lower initial rate that can reset after a fixed period. Shorter terms (for example, 15 or 20 years) often carry lower rates but higher monthly payments, accelerating equity. Longer terms stretch payments and improve monthly affordability at the cost of higher total interest. There is no universal winner; the right pick depends on income stability, savings, and how long you expect to keep the home.

Understanding amortization helps you see where your money goes. Early payments are interest-heavy; principal reduction ramps up over time. Prepayments can shorten the loan and trim interest, though some products include prepayment considerations you should read carefully. Rate buydowns reduce your rate in exchange for upfront fees; whether that trade-off is worthwhile depends on a break-even calculation:

– Break-even months ≈ (points cost) / (monthly payment savings)

– If you’ll stay in the home longer than the break-even period, the buydown may be worthwhile

– If you expect to sell or refinance sooner, preserving cash may be wiser

Don’t confuse interest rate with APR. The APR folds in certain lender and third-party costs, creating a more apples-to-apples comparison across offers. Also ask about mortgage insurance if your down payment is below 20%—the added cost can vary widely by credit profile and loan type.

A rate sensitivity check keeps expectations grounded. As a rough illustration, on a $360,000 loan, a 0.5 percentage point change in rate can swing the principal-and-interest payment by roughly $110 to $130 per month, depending on term. Combine that with property taxes and insurance, which are location-specific, and you can see why pre-approval and updated quotes matter before you submit an offer.

Loan categories you’ll encounter include:

– Conventional financing for borrowers who meet standard guidelines

– Government-backed options designed to expand access, often with flexible down payment rules

– Larger-balance loans for higher-priced markets with stricter qualification

Your aim is clarity, not complexity: match term, risk tolerance, and timeline with a structure that supports your broader financial plan.

Credit, Pre-Approval, and Down Payment Strategy

Credit strength influences not only your rate but also insurance costs and underwriting flexibility. While scoring models differ, higher scores typically earn better pricing. Practical steps to strengthen your file in the months before applying include paying on time, reducing revolving utilization below 30% (and ideally lower), avoiding new hard inquiries unless necessary, and keeping older accounts open to preserve length of credit history. Small changes can compound: trimming utilization from 60% to 20% can materially improve your risk profile.

Pre-approval is more than a letter; it’s a dry run of underwriting. Expect to document income, assets, and debts with pay stubs, tax returns, bank statements, and ID. Consistency is key:

– Keep large deposits traceable

– Pause major purchases and new credit lines

– Maintain stable employment if possible

– Confirm your rate lock window and extension costs

Down payment planning is a balancing act. A larger down payment lowers monthly costs and may eliminate mortgage insurance, while a smaller down payment preserves liquidity for emergencies and repairs. If you put less than 20% down, budget for mortgage insurance, which commonly ranges from a fraction of a percent to more than 1% of the loan amount annually, depending on credit and down payment. Some lenders offer ways to reduce or restructure that cost; compare total five-year costs, not just month-one payments.

Cash reserves matter. Many underwriters prefer to see at least a few months of total housing payments left after closing, especially for multi-unit properties or borrowers with variable income. Gift funds can be allowed under specific documentation rules; ask how to paper the transfer correctly before moving money. If an appraisal comes in lower than the contract price, the “appraisal gap” must be covered with cash, a price reduction, or loan restructuring. Planning for a modest cushion helps keep your deal intact if valuations surprise you.

Finally, align the down payment with your risk comfort. Some buyers favor higher liquidity, expecting to prepay later. Others prefer lower fixed costs from day one. There isn’t a one-size-fits-all approach; the right path is the one that keeps you secure through market cycles and life changes.

Property Inspection Essentials and Risk Control

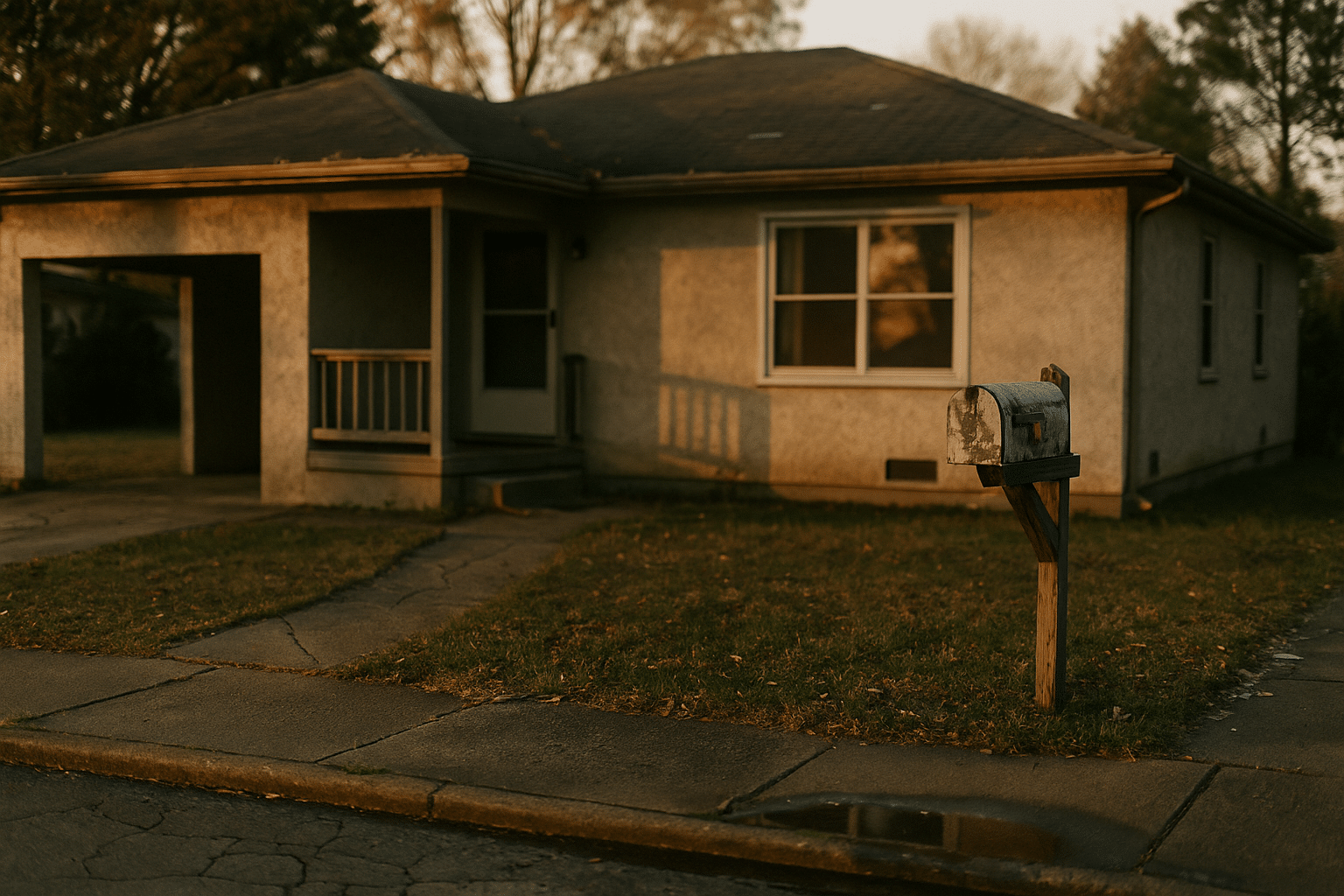

An inspection is your tactical flashlight—shining into the corners where online photos never look. A general home inspection typically reviews roof, foundation, structure, plumbing, electrical, HVAC, insulation, windows, and visible moisture issues. The goal is not perfection; it’s to quantify risk and estimate future costs. Expect a detailed report with photos, ratings for item condition, and suggestions for further evaluation where needed.

Use a systematic checklist:

– Exterior: grading, drainage, siding, roof age, gutters, and downspouts

– Structure: foundation cracks, settlement patterns, framing anomalies

– Utilities: electrical panel capacity, GFCI placement, visible wiring, plumbing material and leaks

– Systems: furnace and condenser age, service tags, filter access, airflow

– Interior: moisture around bathrooms, attic ventilation, window seals, insulation levels

– Safety: carbon monoxide and smoke detectors, handrails, trip hazards

Specialty inspections can save thousands by catching hidden issues. Examples include sewer scope for older lines (tree roots and offsets are common), chimney evaluation, mold sampling where there is a moisture history, radon testing in certain regions, and termite or other pest checks in areas with activity. If the roof is near the end of life or the HVAC looks dated, request service history or a professional opinion on remaining life. Typical ranges vary widely, but a roof replacement often costs five figures, and drain line repairs can escalate quickly depending on access.

Interpreting the report requires context. Nearly every home has a list of minor findings: missing caulk, reversed polarity on an outlet, a slow-draining sink. Group items by urgency and expense:

– Health and safety now

– Preventive fixes soon

– Cosmetic or optional later

Negotiation options include repair requests, seller credits at closing, or price adjustments. Credits are often cleaner, allowing you to choose contractors and standards after move-in. Keep inspection contingencies aligned with the calendar; if you need additional specialists, extend timelines before deadlines pass. The aim is to leave the process with eyes open, a maintenance plan, and no budget surprises.

From Offer to Closing: Timelines, Costs, and Buyer Safeguards

Writing an offer blends analysis with strategy. Use comparable sales to anchor price, but also consider current inventory, days on market, and seasonality. Strong offers are clear, complete, and realistic about timelines. Common contingencies cover financing, appraisal, and inspection; waiving them raises risk and should be balanced with a price concession or other protections. If a counteroffer arrives, focus on total package value—price, credits, repairs, closing date, and inclusions—rather than any single lever.

Expect a closing timeline roughly in the 30 to 45 day range, though local norms vary. During this period, the lender finalizes underwriting, the title company researches ownership and liens, and insurance is bound. You’ll review a closing disclosure that outlines final costs; compare it against your loan estimate and ask questions about any differences. Typical cash to close includes down payment, closing costs, and prorations for taxes and insurance.

Practical safeguards keep the transaction smooth:

– Confirm wire instructions by phone using a known number to avoid fraud

– Keep credit stable; avoid new debts and large purchases

– Track expiration dates for contingencies and rate locks

– Schedule the final walkthrough within 24 hours of closing to verify condition

After closing, create a first-year homeowner plan. Catalog system ages, set reminders for filter changes and seasonal maintenance, and build a sinking fund for big-ticket items like roofs and HVAC replacements. If you chose a higher-liquidity path at closing, consider structured prepayments once you’re settled. If you opted for a larger down payment, maintain a separate emergency reserve to handle life’s curveballs without tapping high-interest credit.

Conclusion: For first-time and repeat buyers alike, a steady process beats speed. Calibrate your budget, pick financing that fits your timeline, use inspections to manage risk, and protect your deal with simple safeguards. The result is not just a signed deed but a home that supports your plans with fewer surprises and more confidence day after day.